1. Your Phone

While most phones can’t fit in standard wallets, manufacturers have created iPhone cases that double as wallets/card holders. They usually include two pockets that allow you to slip in two or four cards and a couple of dollar bills. While they allow you to carry more on you while taking up less space, this combination is quite dangerous. First off, some cards can be tampered with by cell phone waves, making it a bad idea to keep them in the same proximity. Secondly, when you wallet is snatched, it means you will lose your phone as well.

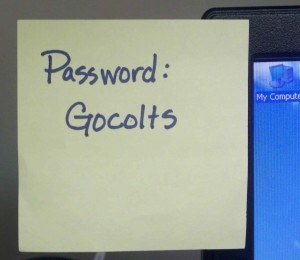

2. Important Codes

3. Social Security Card

Social security cards have a disclaimer at the bottom that the card should be kept in a safe place. This is because a social security number is the ultimate access point to an individual’s personal information. Instead of carrying your social security card in your wallet, consider hiding the card in a unique place instead. Because chances are, if you remember your social security number, there will be very few places you’ll be required to make use of a physical card.

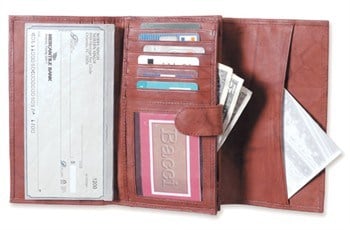

4. The Checkbook

Checkbooks are quickly being replaced by check cards, or cards that take money from your checking account, to allow you to purchase things in the same way you can purchase using a credit card. However, there are still some traditionalists who prefer to write out a nice, crisp check. If you are one of those individuals, consider not carrying your checkbook in your wallet. Instead, look into alternatives like a bank card or simply keeping your checkbook separate from your wallet. Thieves can make use of blank checks and can even transfer money using the information found on checks.

5. Unnecessary Gift Cards

Up until now we have covered what things to not carry in your wallet due to safety and financial security. Now, we are going to cover what you should leave out based on simply up-keeping an efficient wallet. This includes not having unnecessary gift cards in your wallet. Periodically check the balances of the gift cards you have to ensure they are worth keeping. For the ones that are in fact worth keeping, look into applications like Lemon Wallet that digitize your gift cards. Passbook is also a great onboard program that does the same thing. Plus, it’s password protected, which allows you to keep your cards safe.

6. Large Amounts of Cash

This may seem obvious, but there are some people who are against bank accounts…or safes. If you are one of these individuals, you are setting yourself up for a safety nightmare by holding large amounts of cash in your wallet. Once stolen, unlike organized financial accounts, paper money doesn’t have a paper trail, which means you may not be able to recover the stolen bills. For this reason, going plastic is a good alternative. Checking with financial institutions is a good start. For those scared away by these institutions, alternatives like Simple make for approachable financial institutions. If you’re an individual who usually keeps your wallet light, you’d be surprised that individuals keep all of this in their wallets. But it’s true, and not only is it an annoyance to carry around something so bulky in your pocket, we now know it can also be very dangerous.